Stablecoins are the biggest scam of the century

Cet article est disponible en Français.

This article is a summary of Michel Khazzaka’s interview on Surfin’ Bitcoin.

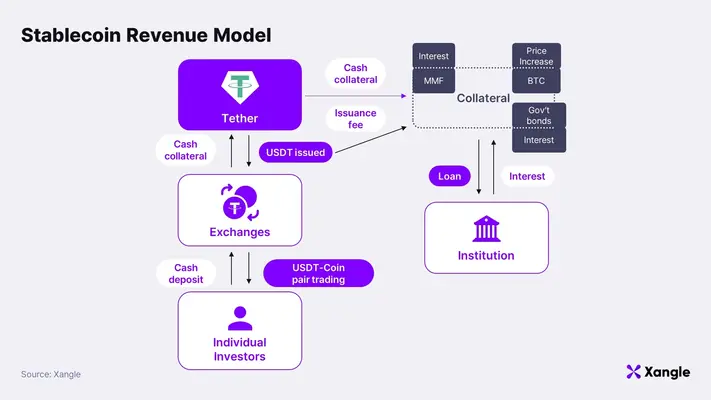

Stablecoins and their revenue models (source)

How does money really work today?

To understand stablecoins, we must first understand bank money, as it’s what we use every day.

Bank money is a promise

When you see €1,000 in your bank account, these are not €1,000 that you actually own; they are €1,000 that your bank owes you.

The only real money is that of the central bank:

- coins;

- banknotes;

- commercial banks’ accounts at the central bank (reserves).

We therefore live in a three-tier system:

| Level | Who? | What type of money? |

|---|---|---|

| 1 | Central bank | ultimate money (indisputable) |

| 2 | Commercial banks | promises of money |

| 3 | Customers | bank balances (banks’ promises) |

Payments between banks

When you pay someone who is at another bank:

- Your bank must withdraw reserves from its account at the central bank.

- It transfers them to the other bank.

- The accounting entries change.

It’s a closed, slow and expensive system because for €100 sent, banks must actually move €100 of central money.

Payments between countries

International payments are even more complicated. Banks must go through correspondent banks that have accounts in other countries. This translates to:

- 2 to 7 days delay;

- high fees;

- total dependence on the US dollar.

This system partly explains why stablecoins exploded: they allow sending value like a WhatsApp message or email, instantly and anywhere in the world.

Why were stablecoins created?

Contrary to the most common misconception, stablecoins were not created to “stabilize” crypto prices.

The real reason is taxes

In Europe and the United States, when you sell a cryptocurrency, you trigger a taxable event (capital gains).

Speculators/traders wanted to be able to exit volatility without paying taxes while staying in the crypto ecosystem; stablecoins offered a solution as they allow keeping a “stable” value without returning to taxable currency.

Instant, global payments

Stablecoins also enabled immediate transfers at very low costs, available 24/7 with no intermediary bank. They became a parallel payment system to that of banks.

How does a stablecoin work?

Let’s take the case of the largest: Tether (USDT). For each USDT issued by Tether there is exactly 1 dollar actually deposited in a bank; we call this deposit collateral. But this dollar doesn’t sleep; the deposited dollars are invested, The issuers almost always buy US Treasury bills (T-Bills) which finance the US government. These bills earn interest and that’s where Tether’s business model (in our example) appears.

The stablecoin business model

Issuers make money through:

- Interest on hundreds of billions of deposited dollars. These are the biggest revenues.

- Commissions when buying/selling the stablecoin.

- Fees on transactions.

Tether is thus today one of the most profitable companies in the world while having fewer than 100 employees.

The fundamental problem is “double spending”

When someone creates 100 USDT for you:

- You must deposit $100 which will be invested in US debt via US Treasury Bills.

- You receive 100 USDT that you can spend

The same dollar is therefore spent twice, once by the government, once by you:

- The US government spends the “real” dollar (via Treasury Bills)

- You spend the “tokenized” dollar

This is what Michel Khazzaka humorously calls quantum double spending.

The direct consequence is inflation

As 1 real dollar circulates in the US economy and 1 digital dollar circulates in the crypto economy, the effective money supply increases; this creates global inflation. Even if the amounts seem small today, projections show additional inflation of 3 to 6% if growth continues[1].

Why does Donald love stablecoins?

The Genius Act

The Genius Act[2] is a brilliant idea to finance US debt and D. Trump understood it very well: stablecoins rely on dollar deposits, these deposits buy US Treasury bills and therefore the planet finances US debt.

Users worldwide who buy USDT unknowingly finance US debt., it’s a kind of voluntary global tax, without vote, without debate.

This is why D. Trump rushed to stop the US CBDC[3] and massively encouraged stablecoins, positioning them as a major geopolitical tool.

Why is Europe slowing down stablecoins?

Europe fears two things:

- That the euro loses its role in payments because if Europeans pay in USDT, the euro becomes marginal, commercial banks lose deposits and the ECB loses control of monetary policy.

- That citizens flee the banking system because stablecoins earn interest (today captured by Tether) that banks cannot offer.

To slow the adoption of euro stablecoins the European MiCA regulation has:

- limited the amounts held in stablecoins;

- prohibited the remuneration of stablecoins;

- restricted operations.

The Digital Euro (CBDC) explained simply

The digital euro is not a new currency

According to the ECB itself, the digital euro is not a currency because:

- There is a holding cap (e.g.: €3,000 max);

- Merchants cannot keep it, it is instantly converted to Euro;

- It is not a store of value.

The digital euro is simply a modern payment method, not a currency.

Why is the ECB creating it?

To modernize the equivalent of the physical banknote:

- ensure that the euro remains used in everyday payments;

- compete with Visa and Mastercard which are American;

- maintain a trust anchor in central money.

It’s a defensive response, not a hegemony project.

Bitcoin is a debt-free monetary alternative

Faced with stablecoins which are private debt and CBDCs which are public debt, Bitcoin is debt-free money. Its well-known characteristics:

- finite quantity (21 million);

- no central bank (decentralized blockchain);

- no arbitrary inflation;

- no mandatory counterparty;

- global network accessible to all (censorship resistant).

Bitcoin positions itself as a strategic asset like gold.

States are starting to accumulate it

- The United States has created a passive national reserve ($25 billion already);

- Central banks will likely be forced to buy some in the coming years (Deutsche Bank analysis).

Strategic model for a state like France

If France bought only 0.5% of its GDP per year in Bitcoin, then, according to models, it could erase a major part of its debt in 20-25 years thanks to Bitcoin’s natural growth; it’s the first technology allowing such a strategy.

To conclude

We are today facing three monetary systems:

| System | Type of money | Asset | Problem |

|---|---|---|---|

| Stablecoins (USDT…) | private debt | fast payments, global adoption | inflation, double spending |

| Digital Euro (CBDC) | public payment method | modernization, sovereignty | not a real currency |

| Bitcoin | debt-free money | store of value, real freedom | short-term volatility |

These three systems will coexist, but Bitcoin is the only one:

- not linked to debt;

- not linked to a bank;

- not linked to a state;

- with immutable monetary policy.

This is what makes Bitcoin a simple and robust alternative in a world where debts are exploding.

The claim that stablecoins will cause inflation is complex and depends on the context and mechanism involved. Stablecoins tied to fiat currencies like the US dollar are not inherently inflationary in the traditional sense, as their value is pegged to the underlying currency, which itself is subject to inflation. For example, if the US dollar loses purchasing power due to inflation, a dollar-pegged stablecoin like USDT will also lose value over time, meaning it does not serve as a hedge against inflation of its pegged currency. However, some economists argue that stablecoins can contribute to inflationary pressures under certain conditions. One key concern is that stablecoin issuers, particularly those backed by US Treasury securities, increase demand for government debt. This creates a captive market that suppresses yields, thereby reducing borrowing costs for the government – a form of financial repression. If confidence in stablecoins erodes and redemptions increase, issuers could be forced to sell Treasury bills, leading to higher yields and potentially increased fiscal pressure. This dynamic could distort market signals and ultimately contribute to higher inflation if real interest rates fell below the level necessary for price stability. ↩︎

White House Fact Sheet ↩︎

Central Bank Digital Currency. ↩︎