Gradually then suddenly

Summary of the book Gradually, Then Suddenly: A Framework to Understanding Bitcoin As Money.

This article is available in French

This article is solely educational and has not been catered to your individual circumstances, and as such, any action or inaction which you may contemplate based on the contents herein should be made in consultation with your personal legal, tax, and financial advisors. Nothing in this article or its associated services constitutes professional or financial advice of any kind (including business, employment, investment advisory, accounting, tax, and/or legal advice). Nothing in this article or its associated services constitutes or forms a part of any offer for sale or subscription of, or any invitation to offer to buy or subscribe for, any securities, nor should it, or any part of it, form the basis of, or be relied upon in connection with, any contract or commitment whatsoever.

Preface

Bitcoin appears as a rupture in the history of money; this rare and decentralized digital monetary system operates without a State or central bank.

Through the book “Gradually, Then Suddenly”, Marty Bent shows how Bitcoin challenges everything we thought we knew: money, trust, sovereignty.

Bitcoin is not just a technology: it offers an alternative to fiat money, which are vulnerable to censorship and inflation.

The adoption of Bitcoin will not happen all at once, it will grow slowly, then everything will accelerate, as was the case for other major innovations.

The strengths of Bitcoin are:

- a predictable monetary policy

- a decentralized consensus

- resistance to censorship

This collection invites us to rethink monetary history and to consider that a new order can emerge.

Introduction

Bitcoin is not just a technical invention: it is a disruption in the way humanity thinks, exchanges, and organizes money.

With Bitcoin, the classical vision of money, power, and trust is called into question; it imposes itself as an alternative to traditional monetary systems which, faced with inflation or censorship, struggle to maintain citizens’ trust[1].

The adoption of Bitcoin moves forward step by step: first by a minority, then by more and more users and institutions who discover its advantages.

This movement, initially discreet, can become irresistible and irreversible.

Through this collection, the author proposes to look at money differently: Bitcoin paves the way for a radical transformation of the economy and society.

Fundamentals

Bitcoin makes all other currencies obsolete

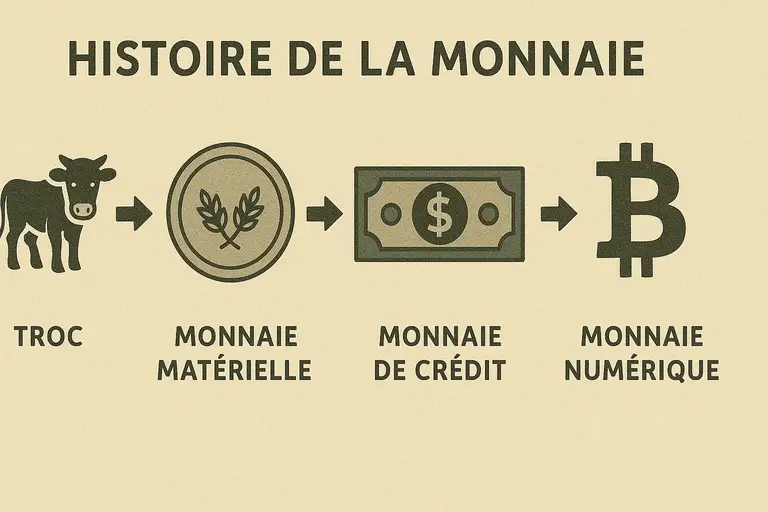

The history of money is a series of innovations where each form of money eventually gives way to another, better suited to society’s needs. For centuries, shells, precious metals, then paper have played this role, each with advantages but also many limitations.

Modern fiat currencies, controlled by states and central banks, are no exception: they are also subject to manipulation, inflation, and censorship.

Bitcoin introduces a total break. For the first time, there exists a currency that brings together:

- absolute rarity

- decentralization

- resistance to censorship

- global portability

- practical impossibility of confiscation or counterfeiting

This synthesis has never existed before: it makes Bitcoin a form of money superior to gold, but also to national currencies, as no authority can change its rules or quantity.

The adoption of Bitcoin follows the dynamics of great monetary revolutions. At first, a few individuals use it to protect themselves from inflation or confiscation. Gradually, as confidence in traditional currencies wanes, the transition accelerates. Economic crises, loss of purchasing power, or even financial censorship push more and more actors to choose a monetary system that guarantees them sovereignty. This adoption is neither sudden nor imposed: it happens “first slowly, then suddenly,” by the free decision of individuals.

Thus, Bitcoin is not simply a new technology or a speculative bet. It marks a paradigm shift: by bringing together all the qualities of good money, it makes the obsolescence of all other forms of money inevitable. This process is part of the long history of money, but this time, it could well be definitive.

Bitcoin is not the blockchain

Industry and the media constantly talk about “the blockchain” as the great innovation of Bitcoin, a tool that could revolutionize almost every sector, from finance to logistics. This discourse completely misses the essential about Bitcoin.

The real innovation of Bitcoin is Bitcoin itself, it is the use of the distributed blockchain on a secure P2P network that is revolutionary, not just the blockchain taken in isolation.

The blockchain only makes sense and is useful in the context of a system like Bitcoin, where it serves to guarantee the integrity of transactions and resistance to censorship, without a central authority. Outside this context, a blockchain is either useless or an inefficient database. Many companies try to sell “blockchain” solutions for everything and anything, but they only reproduce existing systems, often in a more expensive and slower way.

The author insists that Bitcoin did not become revolutionary because it uses a blockchain, but because it brings together an open architecture, an immutable monetary policy, a network of economic incentives, and the possibility of making permissionless transactions. Detaching the blockchain from Bitcoin is to lose all meaning of this innovation: security, decentralization, and trust emerge from the system as a whole, not from a technology taken alone.

In summary, the blockchain is only of interest because it allows Bitcoin to exist. Wanting to copy it in other contexts is to ignore what makes Bitcoin strong and new: the creation, for the first time, of a sovereign and uncensorable digital currency.

Note

Cryptocurrencies rely on a blockchain to ensure the immutability of exchanges but using a blockchain alone does not guarantee either its decentralization or its resistance to censorship.

In reality, cryptocurrencies are not completely decentralized, or not decentralized at all (like XRP that only the company Ripple can issue and validate, this is the centralization of a decentralized process).

It is both the consensus mechanism coupled with the multiplication of servers that validate transactions that ensure the decentralization of cryptocurrencies.

Resistance to censorship also requires that the servers are sufficiently distributed worldwide and above all that it is impossible for one entity to hold the majority of the servers/nodes (51% Attack).

Bitcoin is not backed by anything

It is often heard that Bitcoin would be worthless because it is “backed by nothing,” unlike gold or a currency guaranteed by a State. This idea misses the essential. The value of Bitcoin does not come from a physical asset or a government promise, but from its architecture and unique properties.

Bitcoin derives its value from the security provided by proof of work[2], trust in open and auditable code, scarcity guaranteed by its protocol (with a maximum number of 21 million bitcoins), and the possibility for everyone to verify the system’s rules themselves. It is resistant to censorship, accessible to all, and insensitive to external manipulations. It is because its functioning is transparent and because the interests of each participant are aligned around the preservation of the network that Bitcoin acquires and retains its value.

All forms of money rely on trust: in the State for fiat money, in the stability of gold for commodity money.

Trust in Bitcoin rests on mathematics, cryptography, the incorruptibility of the protocol, and the certainty that no one can cheat or change the rules for their own benefit. By its design, Bitcoin offers a guarantee that no other currency offers: an open, predictable system that does not depend on trust in any central authority. That is where its value comes from.

Bitcoin is “antifragile”

Bitcoin is not only resistant to attacks: it emerges stronger. Each time the network undergoes an attack, a crisis, a ban, or public criticism, it adapts, strengthens, and gains robustness. Where traditional systems collapse under pressure, Bitcoin takes advantage of it to evolve.

Attacks against Bitcoin – whether technical, economic, or regulatory – reveal its weaknesses, but immediately offer the community the opportunity to correct, innovate, and strengthen the protocol. Each difficulty faced by the network becomes an opportunity to improve its security, decentralization, and resistance to censorship. Attempts to undermine user trust or disrupt the system often have the opposite effect: they increase transparency, vigilance, and community engagement.

This “antifragile” character distinguishes Bitcoin from all other forms of money. Its open and evolving architecture not only allows it to survive crises but to emerge stronger. The more attacks and obstacles multiply, the more Bitcoin consolidates its position and proves its usefulness as a sustainable and independent monetary system.

Bitcoin is the great de-financialization

Programmed decadence

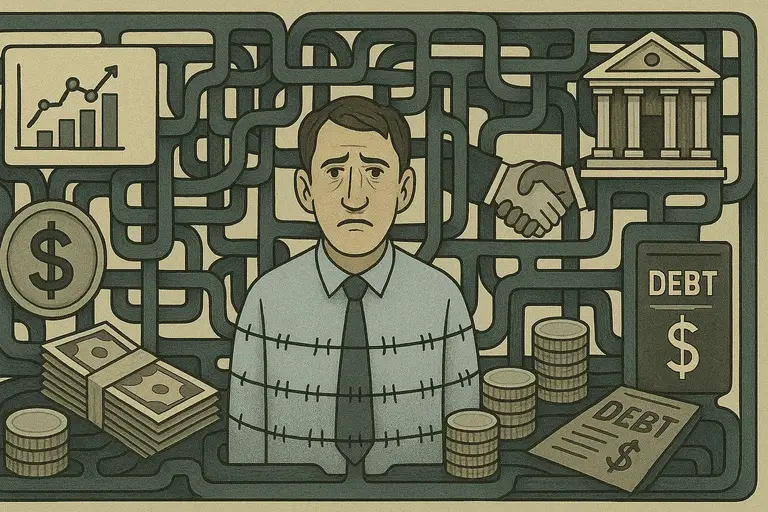

In our society, it seems natural to have to “make your money work”: to invest in hopes of preserving or increasing its value. But this obsession is not trivial: it results from a system where money, by design, loses a little of its value each year, under the deliberate action of central banks. To avoid seeing their savings melt away, everyone is pushed to invest their money, even without real desire or skill, thus exposing themselves to constant risks.

This over-financialization has blurred the distinction between saving (protecting value) and investing (taking risks). Now, everyone is forced to act as an investor, not by choice, but by necessity, simply not to become poorer. The current monetary system thus turns saving into an endless race, forcing everyone to take risks, just to avoid falling behind. This is an absurd mechanism, but it has become the norm: the programmed loss of monetary value makes risk-taking inevitable for all.

Savings vs. Risk

Creating savings first requires taking risks: working, training, producing value. The money earned should allow one to preserve the fruits of their efforts for the future. But today, as money constantly loses value due to central bank policies, it becomes impossible simply to save: everyone is obliged to reinvest, therefore to take new risks, just not to become poorer.

This confusion between saving and risk-taking is artificial: it exists only because the currency is deliberately devalued. You do not “make your money work” to get richer, but to avoid it melting away. This system forces everyone to play a risky game, whereas good money should allow value to be preserved without additional effort. This is what Bitcoin offers: solid savings, without imposed risk.

The great financialization

Because money constantly loses value, everyone is pushed to invest to protect their savings. This race to preserve purchasing power has enabled finance to take a huge place in the economy: complex financial products, oversized markets, stacked risks. The boundary between saving and speculation has disappeared: investing has become obligatory, not by choice but by necessity.

This system, a direct result of monetary creation and organized inflation, has transformed every citizen into a risk taker despite themselves, making the economy unstable and dependent on ever more invasive finance.

Consequences of discouraging saving

When money is programmed to lose value, saving becomes a losing bet: keeping your money means becoming poorer, and taking risks becomes an obligation, not a choice. This system deprives everyone of the possibility of preserving the fruits of their efforts, even though every individual has already taken risks to earn this money. In a free market, the value of money should fluctuate naturally, but guaranteeing its depreciation institutionalizes a logic where one prefers to consume or invest at any cost, even without discernment, rather than save.

Little by little, the very idea of saving disappears: everything is oriented towards the short term, risk-taking is trivialized, and reflection on the future fades. Economic decisions, whether to invest or consume, are made without stable benchmarks, distorted by the fear of loss of value. Keynesians fear that a stable currency would slow investment, but in reality, an incentive to save would allow wiser choices and a healthier economy: investments would be more productive, consumption more thoughtful.

On the contrary, the programmed depreciation of money encourages excessive financialization, the accumulation of risks and makes the economy fragile. When saving no longer makes sense, society becomes vulnerable and unable to cope with the unexpected: the fragility of the system then becomes inevitable.

The paradox of a fixed money supply

The lack of savings and economic instability stems primarily from distorted monetary incentives: this is what Bitcoin corrects. With a supply limited to 21 million bitcoins, it is impossible to create money at will. This scarcity aligns incentives: everyone is pushed to save, because the currency no longer depreciates. Even if a bitcoin is divisible, there will never be more; the money supply is therefore perfectly inelastic. This creates a paradox: if it is not possible to accumulate more money in total, the incentive to save becomes very strong at the individual level.

Indeed, if one expects money to gain value, one is naturally tempted to defer purchases or investments, which does not eliminate consumption, but makes it more thoughtful. Every transaction becomes a real competition: to obtain money, one must offer something sufficiently valuable to others. This dynamic creates a virtuous circle: the incentive to save pushes everyone to produce more value in order to consume or invest.

Ultimately, even if no one can “create” more money, the economy remains active, because daily needs and the preference for the present persist: everyone must consume and invest, but the ability to defer these choices without penalty makes the whole system healthier and more efficient. Thus, Bitcoin does not block the economy, it simply steers decisions towards more prudent and aligned resource management.

For several decades, the financial sphere has continued to expand, gradually absorbing all dimensions of the economy and daily life. Financial markets, derivatives, debts, and speculation have become ubiquitous, to the point that money itself has lost its fundamental function: simply being an instrument of exchange and store of value accessible to all. Financial institutions, through the complexity of products and the stacking of intermediaries, have created a universe where access to value depends on trust in third parties, distant promises, and opaque systems. The individual finds themselves trapped in a system where they no longer own anything directly: everything passes through bank accounts, contracts, guarantees, flows of promises and debts.

Bitcoin and the great de-financialization

Bitcoin redefines saving: it offers the possibility of owning a fixed and unalterable share of the global money supply, without anyone being able to dilute it through monetary creation.

Unlike the current system where currency depreciation has pushed everyone towards risky investment and financialization, bitcoin puts the incentive to save at the center. This shift, already underway, will accelerate as the limits of the traditional financial system appear, notably in the face of anomalies such as negative-yielding debt or massive money printing by central banks.

As bitcoin establishes itself as a monetary standard, it attracts wealth stored in financial assets: stocks, bonds or complex products will lose their appeal in favor of a reliable monetary asset. This will lead to a decline in the financial sector, a contraction of credit, and a reduction in the weight of finance in the economy.

People will gradually abandon risky investments for saving in bitcoin, seeking the simplicity and security of a truly rare and manipulation-resistant currency.

This transition will restore the fundamental difference between saving (preserving value without risk) and investing (taking a risk in hopes of more). Finance will remain useful, but its size and influence will decrease, as the economy refocuses on the creation of real value and direct exchange. The banking system will lose its central role, and money will circulate more freely among productive actors.

In the end, bitcoin promises to free individuals from the permanent obsession with portfolio management: with sound money, everyone will be able to devote more time to creating and living, without fearing that their savings will melt or that they must constantly take unnecessary risks.

The de-financialization of the economy could thus open the way to a more stable, simpler society, more focused on the essentials.

Bitcoin is the possibility for each person to hold, exchange, and transmit value without depending on any third party, without suffering inflation, censorship, confiscation, or the bankruptcy of a central actor. It is the reappropriation of money by the individual, the end of the reign of promises and credit, the return to real ownership and monetary freedom.

Common misconceptions

Alchemy

Bitcoin cannot be copied

Since the financial crisis, creating money out of nothing has become a commonplace reality, previously reserved for central banks. Bitcoin was precisely invented to end this privilege: with its limited supply, no one can create more at will. Yet, since its appearance, thousands of cryptocurrencies have tried to replicate (or “improve”) Bitcoin, whether by copying, forking, or new protocols. Each promises to be faster, more stable, or more flexible, but all actually seek to recreate money out of nothing, like the alchemists of old.

Yet the true innovation of Bitcoin is its free emergence on the market—a phenomenon comparable to the emergence of gold as money. Many prefer to ignore this revolution and rush toward copies or derivatives, believing in easy enrichment. But every attempt to “do better than Bitcoin” is just another form of alchemy: an illusion that forgets that only scarcity and lack of manipulation give money its true value.

The value and unique properties of Bitcoin

An asset whose main utility is to be exchanged for goods and services, without a link to income production like a stock or a bond, must compete as a form of money: it can only store value if it has real monetary properties. Those who copy Bitcoin by adding “features” miss the essential: the value of Bitcoin comes from stable rules that cannot be arbitrarily changed. Copying the code is not enough, because Bitcoin only became money over time, as a global network of users emerged and monetary properties (decentralization, resistance to censorship) imposed themselves spontaneously.

This gradual emergence makes Bitcoin almost impossible to reproduce today. As its value increases, it becomes more decentralized and resistant to attempts to change the rules or censor transactions. It is precisely this stability and resistance that guarantee the credibility of its supply limited to 21 million units. Thus, Bitcoin has become the most decentralized and censorship-resistant monetary system in the world, generating a virtuous circle: the more it gains value and scope, the more its monetary properties are strengthened, consolidating its status as a store of value.

Monetary convergence and Bitcoin

Economic systems naturally tend toward a single form of money because the primary utility of money lies in its liquidity and ability to facilitate exchange, not in consumption or production. All currencies—fiat, commodities, or cryptocurrencies—compete for this same role, even if this is not always perceived. It would be irrational to store value in a smaller, less liquid, and less secure monetary network when a larger, safer network exists. Logically, faced with two currencies, one will always choose the one that is most accepted and easiest to exchange.

That is why, in practice, most people keep their wealth in a single currency, not because there are no others, but because liquidity and widespread acceptance take precedence. People in countries experiencing high inflation, like Venezuela or Argentina, would prefer to hold dollars if they could. Similarly, those who invest in a copy of bitcoin are voluntarily choosing a less liquid and less secure monetary network.

If today currencies like the dollar are more liquid than bitcoin, those who adopt bitcoin do so because they believe its fixed supply is a better long-term store of value and bet on the growing adoption of other users, thus strengthening its liquidity and robustness.

The combination decentralization → resistance to censorship → fixed supply → store of value makes Bitcoin a credible alternative in this convergence dynamic.

The uniqueness of Bitcoin

Most creators of digital currencies do not recognize that their project must become real money to succeed, and speculators underestimate the tendency of monetary systems to converge on a single medium. None can explain how their currency could surpass Bitcoin in decentralization, censorship resistance, or liquidity. Without these properties, it is impossible to have a credible monetary policy.

The value of Bitcoin does not depend on a particular feature, but on its finite digital scarcity, which makes it a store of value. This scarcity is credible only because Bitcoin is truly decentralized and resistant to censorship, qualities that do not depend on the software but on the network itself. These properties attract adoption and strengthen liquidity, making the Bitcoin network ever stronger and unique, while other monetary networks decline.

To understand the strength of Bitcoin is to grasp three points: its scarcity, the value it derives from it, and the natural tendency of economies to converge on a single currency. The market, through its experience and choices, has validated Bitcoin as a reliable store of value, dismissing alternatives despite the multiplication of competitors. Thus, Bitcoin cannot be copied or surpassed, because it is its emergent properties, reinforced by market consensus, that form its superiority.

The minority rule and Bitcoin

Nassim Taleb explains how a small, uncompromising minority can impose its preferences on the majority, a phenomenon he calls “the minority rule”[3]. Monetary systems perfectly illustrate this principle: if a convinced minority of Bitcoin’s monetary superiority refuses any other currency, while the majority accepts several alternatives, it is the minority that will prevail. This is what is currently happening in the global competition of digital currencies: a determined minority swears only by Bitcoin, rejecting all other cryptocurrencies, and ends up imposing this choice on the rest of the market.

Diversifying between different digital currencies ultimately means letting the majority decide for you and risking losing part of your value. It is better to focus on the fundamentals and understand “the minority rule” before exchanging your savings for uncertain promises.

Bitcoin is a remarkable cryptographic achievement, and the ability to create something that is not duplicable in the digital world has enormous value.

– Eric Schmidt, former CEO and executive chairman, Google[4]

Bitcoin is not so volatile

The volatility of Bitcoin: obstacle or strength?

Many reject Bitcoin on the grounds that it is too volatile to be a currency, especially after witnessing sharp rises followed by brutal falls. Yet, after a few years, Bitcoin is still there, and its value continues to rise, pushing some skeptics to reconsider their judgment. This volatility, often criticized by central bankers, is actually a natural stage in the adoption process of a new currency.

Today, Bitcoin mainly serves as a long-term store of value, not as a daily means of payment. Its volatility reflects the gradual discovery of its price on the global market. Over time and with mass adoption, its stability should increase. Finally, most users diversify their holdings, which reduces the impact of volatility on their overall wealth. Thus, far from being a weakness, the volatility of Bitcoin helps to strengthen the understanding and conviction of its users, while contributing to its maturation as a real currency.

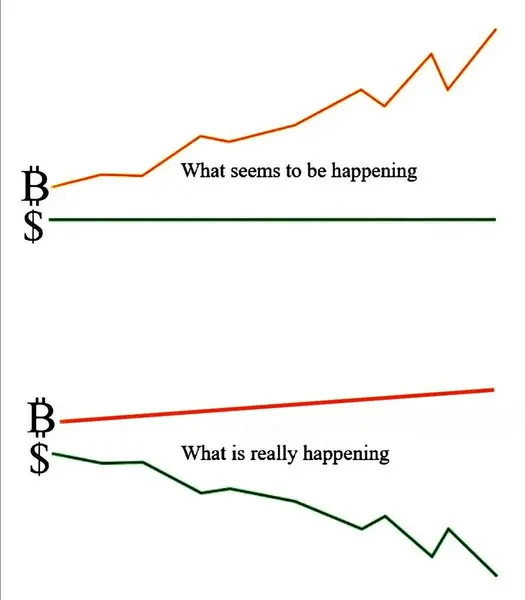

Volatility and Bitcoin’s store of value power

It is common to think that a volatile asset cannot be a good store of value, and vice versa. Yet, the stability of an asset like the dollar does not make it an effective store of value, as its real value slowly but surely decreases. Conversely, Bitcoin’s volatility does not prevent its ability to preserve value over the long term.

Institutional critics blame Bitcoin for its lack of stability, arguing that it cannot serve as money or a store of value. But these judgments are based on a short-term view, while the real question is one of time horizon: over years or decades, Bitcoin has demonstrated its ability to preserve value much better than currencies like the dollar or the euro, continually devalued by central banks.

In reality, Bitcoin’s volatility is a sign of its youth and the natural process of price discovery. It is not synonymous with risk or inefficiency, but with the market’s adaptation to a new form of money. Traditional experts overlook the fact that Bitcoin was created precisely to respond to the failures of the current monetary system: despite volatility, it has proven to be an exceptional store of value over the long term.

Volatility and Bitcoin’s scarcity

The fundamental demand for Bitcoin comes from its scarcity: it is valuable because its supply is strictly limited. This characteristic also explains its volatility. As demand for Bitcoin increases—often exponentially—the gap with the fixed supply widens: there is never a response by increasing production, unlike any other commodity or currency. This tension between variable demand and immutable supply, coupled with imperfect information among market participants, naturally generates volatility over the course of price discovery.

Decentralization and resistance to censorship reinforce the credibility of this scarcity, the foundation of Bitcoin’s store of value function. As Nassim Taleb reminds us, “variation is information”: so Bitcoin’s volatility is not a flaw, but a sign that the market is absorbing new information. As the price fluctuates and reaches new heights, Bitcoin attracts new capital and users, which fuels new waves of adoption.

The adoption dynamic of Bitcoin: a cyclical process

Over the years, each increase in Bitcoin’s value attracts new curious people who seek to understand its fundamentals, which then stimulates the creation of new infrastructures (platforms, services, tools). This virtuous circle—knowledge, infrastructure, adoption, value—repeats itself with each wave, strengthening the ecosystem. Today, despite still very low global adoption, each new wave causes significant volatility: the massive arrival of users makes demand soar much faster than supply can adjust. But as the user base grows, volatility will decrease, as each new arrival will have a relatively smaller impact.

Thus, as long as adoption progresses in spectacular stages, fluctuations will remain strong and natural. Ultimately, when adoption stabilizes, volatility will fade. Between waves, the cycles of rise, correction, and stabilization simply reflect the gradual discovery of price and the maturation of the market, an inevitable process for any new currency.

Between 2015 and 2019, Bitcoin adoption exploded, multiplied by ten, while supply only increased by 23%. In this momentum, each new arrival, often inexperienced, participated in setting the price, which naturally generated strong volatility. Yet, over time, some of these newcomers have acquired knowledge and become long-term holders, stabilizing demand and raising Bitcoin’s base value much higher than before.

This phenomenon shows that volatility, far from being abnormal, reflects the process of adoption and price discovery. As long as Bitcoin remains young and each adoption wave represents a significant share of total demand, fluctuations will remain strong. But as the user base expands, volatility will naturally decrease over the cycles.

Why Bitcoin adoption progresses despite volatility

If we accept that Bitcoin’s volatility is natural and inevitable, it remains to understand why adoption continues to grow. The key lies in diversification, portfolio allocation, time horizon, and the gradual spread of knowledge. Bitcoin allows value to be stored and transferred globally with a fixed supply, but its potential is still little understood, explaining its low valuation compared to other assets like Facebook or the entire U.S. wealth.

Bitcoin’s volatility would be problematic if it were isolated, but in a diversified portfolio, its influence is mitigated by other more stable assets. Those who really know Bitcoin know that, over time, adoption will spread as information circulates. This process is not all or nothing: it is possible to expose one’s portfolio to Bitcoin in a measured way, to take advantage of it without being exposed to unsustainable risk.

As a superior currency, Bitcoin will continue to attract an increasing share of global value, even if it is not yet used daily as a means of payment. As its capitalization and liquidity increase, its volatility will naturally decrease. It would be unwise to invest more in Bitcoin than you can afford to lose, but to completely ignore this asset in a portfolio would also be a mistake. Each day Bitcoin survives makes it more robust: over time, its purchasing power and stability should increase.

From store of value to exchange currency: the natural evolution of Bitcoin

Bitcoin is not intended to become immediately a daily exchange currency. At first, it is logical to spend assets that lose value (dollars, euros, gold…) and save in bitcoin, whose value increases. The first step toward Bitcoin monetization therefore passes through its adoption as a store of value, a role in which it excels despite its volatility.

As people and businesses recognize this ability of Bitcoin to preserve value, they become willing to accept it as direct payment.

Only once this confidence is acquired can Bitcoin truly serve as an exchange currency, its adoption then generating new needs and infrastructure for transactions.

This process is gradual: infrastructure stimulates adoption, and vice versa.

Bitcoin’s current volatility is the natural reflection of this rapid adoption faced with a fixed supply. But as the user base expands, stability will gradually emerge, unlike traditional currencies whose artificial stability creates long-term risks. In short, Bitcoin’s volatility is a sign of vitality and long-term balance, not a weakness.

Bitcoin does not waste energy

Why is the energy consumed by Bitcoin essential?

To understand why Bitcoin consumes so much energy, one must first grasp the fundamental role of money in society. Many criticize the energy consumption of the bitcoin network without realizing that this expenditure is precisely what guarantees the security and integrity of the monetary system. Without this understanding, it seems unjustified to devote so many resources to it.

Concerns about Bitcoin’s environmental impact, often relayed in the media, overlook the crucial importance of dedicating energy to securing a reliable monetary network. In the long term, there may be no more vital use of energy than preserving trust in money.

Energy, keystone of the security of the Bitcoin network

The Bitcoin network relies on a multitude of decentralized nodes: some validate and relay transactions, others—the miners—devote colossal computing power to proof of work to secure the chain and validate history[5]. This activity requires about 7 gigawatts of electricity, as much as six million American households, to guarantee the integrity of the system.

Many question the legitimacy of such an energy expenditure, especially in the face of environmental challenges. Yet this consumption is the price to pay to offer a reliable alternative to a failing traditional monetary system. Without understanding the fundamental value of Bitcoin, it is impossible to judge whether this cost is justified.

To mitigate criticism, Bitcoin defenders argue that the network stimulates innovation in renewables, uses wasted or non-exploitable energy, and promotes better management of power grids. But the essential is elsewhere: securing Bitcoin may be, in the long term, the most crucial use of energy, as the stability of the global economy depends on the solidity of money.[6]

The Venezuelan crisis: when money collapses, everything collapses

Venezuela, despite its immense oil reserves, offers a striking example of a country plunged into chaos because of the collapse of its currency. Hyperinflation destroyed the bolivar, making access to food or health extremely difficult and causing a real humanitarian crisis.

Deprived of a stable currency to organize its economy, the country saw its oil production collapse, unable to import technology or coordinate the necessary resources. Result: energy shortages, power outages, essential services paralyzed.

This tragedy shows that when money loses its cohesive function, the entire economic chain falls apart: prices become incoherent, real goods become scarce, the population flees the local currency, and the whole country sinks into misery. The Venezuelan example perfectly illustrates the ravages of monetary manipulation and the loss of trust in money.

Developed currencies: an illusion of security

Many think that the monetary collapse seen in Venezuela could never affect developed countries. Yet, the foundations of fiat currencies like the dollar, euro, or yen are identical to those of the bolivar: their creation costs nothing, whether it is a dollar or a thousand billion. The recent history of the United States illustrates this well: after 2008, the Fed multiplied the monetary base by twenty-two in a few decades, accelerating the depreciation of the dollar.

Even Fed economists admit their limits in understanding the impact of this massive monetary creation. Yet, the answer was always the same: print more money, hoping for different results. This process inevitably weakens the currency, which loses value over time.

Today, we are faced with a choice: continue to trust a centralized system doomed to devaluation, or adopt a decentralized currency with a limited supply, like Bitcoin. Certainly, this alternative requires energy, but it offers in return the long-term monetary stability that the current system can no longer guarantee.

Securing money: why Bitcoin’s energy is crucial

Tomorrow’s economic stability depends above all on the security and reliability of the monetary system and the trust placed in it, and this is where Bitcoin plays a key role.

Thus, the energy consumed to secure the Bitcoin network is not a waste, but a guarantee of stability for the economy and society. If money collapses, the entire social fabric unravels.

Protecting money must therefore come before all else: it is the condition for other uses of energy to remain possible.

In reality, Bitcoin does not deprive society of energy, it rather ensures access to it by guaranteeing monetary trust. The more people seek this stability, the more energy the network will use, but this cost remains minimal compared to the risks of hyperinflation.

Ultimately, the best use of energy in the long term is indeed to secure a solid monetary system like Bitcoin.

The slowness of Bitcoin is a guarantee of security

Many observers criticize the slowness of the Bitcoin network, estimating that its confirmation times (about ten minutes per block) prevent it from competing with the speed of modern payment systems. However, this criticism is based on a misunderstanding of the primary mission of Bitcoin and the technical choices that result from it.

The apparent slowness of Bitcoin is not a weakness but a deliberate choice, designed to guarantee security, decentralization, and resistance to censorship. In a traditional system, speed relies on centralization and trust in a third party. On the contrary, Bitcoin relies on a global decentralized consensus, where each transaction must be validated by the entire network. This process, certainly slower, avoids fraud, errors, and any form of arbitrary intervention.

Furthermore, considering speed as an absolute criterion for judging a currency is to forget that the robustness and predictability of a monetary system are much more essential, especially in a hostile or unstable environment. Bitcoin’s confirmation times provide unparalleled security: once confirmations are acquired, it becomes virtually impossible to go back.

To meet everyday needs, complementary solutions such as the Lightning Network are already in place and allow near-instant payments, while relying on the strength of the main network. Thus, Bitcoin combines the best of both worlds: the security of a decentralized ledger and the speed of a second-layer payment network.

Ultimately, the slowness of Bitcoin is not a flaw but an essential characteristic of its mission: to offer everyone, everywhere in the world, a reliable, neutral, and censorship-resistant digital currency, without dependence on a central authority.

Bitcoin is for criminals: an unjustified criticism

For a long time, Bitcoin had the reputation of being the ally of criminals, because of its beginnings on illegal markets like Silk Road. However, if we follow the money trail around the world, it is cash and traditional banks that circulate most illicit funds, far ahead of the blockchain. On Bitcoin, every transaction leaves a public trace, engraved forever. Determined investigators, by following these digital footprints, have already unmasked and arrested many crooks who thought they were acting in the shadows.

Financial institutions, meanwhile, continue to flounder in money laundering scandals, while pointing the finger at Bitcoin. But the reality is quite different: it is impossible to discreetly make millions disappear on the blockchain, where every movement is visible, analyzable, and often traceable to its origin.

Technological innovations have always frightened, accused of serving evil before liberating entire societies. Bitcoin is no exception: it is not the den of criminals, but the promise of transparent finance and recovered sovereignty for those who need it.

Bitcoin, a technology impossible to stop

Since its beginnings, many have wondered if Bitcoin could simply be banned by governments. The idea seems simple: a law would be enough to sweep away digital money.

However, this view radically underestimates the decentralized and resilient nature of Bitcoin.

Unlike a centralized service, Bitcoin has neither office, nor CEO, nor single server to shut down. It operates thanks to thousands of nodes spread all over the world, held by anonymous and passionate people, often ready to circumvent any attempt at prohibition. Even if a country officially banned Bitcoin, it would be practically impossible to prevent its citizens from accessing it: the network adapts, transactions hide in ordinary internet traffic or use alternative channels such as satellites or radio.

History has already shown: the more a technology is prohibited, the more difficult it becomes to control; governments can certainly make life difficult for users, limit access to official platforms, or threaten exchanges.

But in the end, any attempt to ban Bitcoin only strengthens its resilience and increases the ingenuity of its community.

Bitcoin is not just software, it’s an idea: that of a free currency, accessible to all, which cannot be confiscated or censored. And ideas, they are impossible to ban.

Bitcoin is not a Ponzi scheme

Since its beginnings, Bitcoin has often been accused of being just a modern Ponzi scheme, where only the first arrivals would profit at the expense of newcomers. However, when you look closely at how Bitcoin works, this criticism does not hold.

In a Ponzi scheme, new investors are constantly needed to pay the old ones, and the system always ends up collapsing when the inflow of money stops. Now, Bitcoin does not promise anyone guaranteed returns nor does it redistribute the funds of new entrants to the oldest. It does not rely on a central organization, but on an open protocol, where everyone is free to enter or leave at any time, without obligation or promise of gains.

Unlike a pyramid, the value of Bitcoin comes from its utility: it allows payments without intermediary, offers guaranteed digital scarcity, and gives everyone sovereignty over their assets. The first participants certainly benefited from an advantage, but as with any major innovation, it is those who understood the potential from the start who benefited. This is not a trap, but simply a sign of progressive adoption.

Bitcoin does not collapse when new users stop arriving: it continues to function, secured by a global network of miners and users. It is not a scam, but a monetary revolution, based on transparency, freedom, and trust in code rather than empty promises.

Bitcoin versus Dollar

Bitcoin is an antidote to the system’s excesses

In a world plagued by inflation, corruption, and arbitrary confiscation of wealth, many end up losing faith in money, institutions, or even the idea of justice. Financial crises, devaluations, and monetary manipulations are not accidents, but the result of a system where a few control the issuance of money, to the detriment of all others.[7]

Faced with this observation, Bitcoin appears as a radical break. Here, there is no central bank or politician who can print at will: the rules are embedded in the code, transparent and immutable. With the number of bitcoins limited to 21 million, everyone knows where they stand. This digital scarcity gives a stable and predictable value, preserving savings from monetary erosion.

But Bitcoin goes further. It also protects against confiscation and censorship: no one can block a payment or seize funds without your consent. Money becomes a neutral instrument again, accessible to all, without discrimination of borders or status.

This gives every individual the opportunity to participate in the global economy on an equal footing, without fear of arbitrariness.

Of course, Bitcoin is not a magic solution to all the world’s ills. But it offers everyone a concrete tool to protect themselves, regain control of their financial life, and build a fairer future, where trust no longer rests on promises, but on transparent, shared, and inviolable rules.

Bitcoin is a rallying cry for financial freedom

In a world where trust in institutions is crumbling, where money is devaluing, and where individuals feel increasingly powerless in the face of decisions by the powerful, Bitcoin emerges as a rallying cry. It is not just a technology or a new financial asset, but a movement born of a deep need for justice, sovereignty, and emancipation.

Everywhere, people are waking up and realizing that traditional money, controlled by central banks and governments, can be manipulated to their detriment. Economic crises, inflation, and arbitrary confiscation of funds are no longer distant threats: they now affect millions of people around the world. In the face of this reality, Bitcoin offers a concrete and radical alternative: a monetary system without a master, open to all, where everyone can participate without permission, where the rules are transparent and immutable.

This movement attracts not only technophiles and investors, but also those who, everywhere on the planet, want to take back control of their savings and their future. For many, adopting Bitcoin means regaining hope and dignity, refusing resignation and affirming their freedom in the face of arbitrariness. More than an innovation, Bitcoin becomes the symbol of collective resistance, a call to rise for a fairer and freer society.

Common sense!

Over the years, trust in traditional money has eroded. People have seen the value of their savings evaporate with inflation, witnessed bank failures, and suffered arbitrary policies decided without their consent. In the face of this reality, Bitcoin appears not as a fad or a craze reserved for technophiles, but as a common-sense solution to increasingly visible problems.

In a world where everyone must trust fallible intermediaries, Bitcoin offers an alternative: a currency managed by mathematical rules, known to all and impossible to manipulate. Here, there is no longer any need to believe in the word of a banker or politician. Transactions are transparent, the number of bitcoins is limited, and everyone has full control over their funds.

This choice, which may seem radical to some, is actually very simple: it is about taking control of your money, protecting yourself against the unexpected, and participating in a system where trust is replaced by verification. Where the current system multiplies crises and injustices, Bitcoin offers stability, predictability, and fairness, accessible to all without distinction.

Ultimately, adopting Bitcoin is simply returning to the essentials: an honest, reliable currency, at the service of everyone. A gesture of common sense in an uncertain world.

Bitcoin is a currency for all

In a world divided by borders, social classes, and unequal access to resources, Bitcoin emerges as a radically inclusive experiment. Its protocol knows neither nationality, nor status, nor privilege: it treats every user equally, whether billionaire or refugee, citizen of a big country or inhabitant of a remote region.

Where traditional monetary systems are shaped by the powerful to serve their interests, Bitcoin offers a neutral alternative. Its access is open to all, without permission, without discrimination or censorship. No need to prove your worth or get bank approval: you just need a connection and a bit of curiosity to join this global network.

Around the world, individuals of all backgrounds are seizing this tool to safeguard their savings, send money to loved ones, or free themselves from the surveillance and restrictions imposed by authoritarian regimes.

Bitcoin then becomes the silent and invisible link uniting strangers, a promise of unprecedented financial equality on a planetary scale.

- Bitcoin is not just a technology: it is an invitation to rethink money as a common good, finally freed from barriers and privileges.

- Bitcoin is the possibility for each person to join a collective story where, for the first time, the rule is the same for all.

Conclusion: Bitcoin, the dawn of a new era

As the world moves forward, Bitcoin rises, carrying a radical promise: that of a currency that belongs to no one, and yet belongs to all. Economic history is littered with failures, manipulations, and crises caused by blind trust in institutions. But now comes an alternative, forged in code and transparency, where everyone becomes the guarantor of the collective rule.

The path has not been without obstacles. First ignored or ridiculed, Bitcoin has weathered storms, defying bans, criticism, and prejudices. It has survived because it embodies an idea stronger than any wall: that of individual sovereignty, resistance to censorship, of power returned to everyone’s hands.

Today, a new generation is taking it up, not out of simple speculation, but out of conviction. For many, Bitcoin is not just an asset or a technology: it is a tangible hope, a response to arbitrariness and injustice. It does not promise perfection, but offers common ground to build, experiment, and dream of a system where trust is earned, verified, and no longer just claimed.

At the dawn of this new era, the choice is open: remain attached to the old world, or embrace the promise of freedom, responsibility, and innovation carried by Bitcoin. No matter the pace of adoption, the movement is launched; it will only grow, “gradually, then suddenly.”

if trust in fiat currency erodes, the state can then resort to more or less violent measures, political, regulatory, or military, to preserve monetary stability.

See the book « La Monnaie : entre violence et confiance » by Michel Aglietta, André Orléan ↩︎Proof of Work (PoW) is a consensus mechanism used in blockchains to validate transactions and create new blocks. It relies on the resolution of a “complex mathematical problem” by miners, who use their computing power to find a valid solution.

The first miner to solve this problem is rewarded with blockchain tokens, such as bitcoins in the case of Bitcoin. This method allows a choice to emerge by chance in a decentralized way (no one chooses at random, randomness emerges by itself).

This randomness is relative because it depends on the computing power of each miner and, in the case of Bitcoin, the problem is solved by brute force which ensures the absence of strategy, trickery or particular skill. For more about Bitcoin’s PoW. ↩︎Nassim N. Taleb, “The Most Intolerant Wins: The Dictatorship of the Small Minority,” Incerto (blog), Medium, 19 August 2016. ↩︎

Eric Schmidt and Jared Cohen, “The New Digital Age: Authors Eric Schmidt and Jared Cohen in Conversation with Facebook’s Sheryl Sandberg,” interview by Sheryl Sandberg (Mountain View, CA: Computer History Museum, 3 March 2014), catalog number 102740112. ↩︎

NDT: The majority of energy consumption is used to make the bitcoin protocol a decentralized system.

The miner who will write a block to the blockchain must emerge by chance but it is out of the question for a third party to have the power to choose at random because then the system would become highly centralized. The energy consumption of each miner is then used to try to randomly find a number impossible to determine in advance, the nonce, which meets a very precise characteristic. The difficulty in finding the nonce is recalculated every week to ensure that a nonce is found on average every 10 minutes, which ensures not only decentralization but also makes it unalterable/unattackable. ↩︎NDT: if the planet becomes uninhabitable due to excessive energy consumption, at least we know that Bitcoin is secure. ↩︎

The practice of “Quantitative Easing” for example is a form of monetary manipulation:

- The central bank “prints” money electronically (the modern printing press).

- It buys government bonds or other financial assets from banks or institutional investors.

- Banks get fresh money, which increases their capacity to lend.